Will The Bull Fall Victim to Coronavirus?

It’s the longest running bull market in history. But it has given up 4000 points in 5 days. What is to be done?

“…investors may have little need to take action if their portfolios are diversified and aligned with their long-term plan.” Jeffrey Kleintop of Charles Schwab wrote on January 31 in his article about the Coronavirus (nCoV2019) impact on markets.

I must reiterate those words even today after a five day beat down of equities. While the Dow has fallen over 4000 points in five sessions, Treasuries have risen sharply offsetting some of that decline . A flight to safety is not uncommon when dealing with an uncertainty like nCoV2019, especially with cases popping up in Europe from unknown sources. And the Dow was near the milestone of 30,000. It’s not unusual to see selling, albeit not like this. This being a Friday adds to it, too. If you have not diversified and do not have fixed income (bonds) in your portfolio you have found yourself in a rather unsettling situation.

Remain seated with your seatbelt securely fastened.

Just like hitting turbulence mid-flight, if you bailout the window now you won’t be in your seat when the aircraft lands safely. If you’ve gone on this journey with no hedge; bonds, non-correlated assets, options or otherwise diversified your portfolio then stay in during the bounce. There is no guarantee that your portfolio will recover within your time frame, but if you bailout you reduce your chances of being in when the recovery starts. I see people make the mistake of selling after losses and not going back into the market until they feel better about it. You know, after the market has recovered. They miss the recovery.

At the moment things are unsettling. In the future we will point to it on a chart as we point to other disruptive events from which our portfolios recovered.

I’ve said it often.

Anyone who has had even the lightest conversation with me about investing knows my position on asset allocation; a properly allocated portfolio is required because whatever causes part of your portfolio to go down will cause another part to go up. Over longer time horizons this will almost always remain true. We’ve see equities going down in value and bonds going up during this week.

I think my past readers and my clients are clear on my view of dividends, too. They become the silver lining during these moments of volatility. Regardless of where the stock price is, you still get paid the dividend. And if you’ve been wise enough to reinvest those dividends you will buy more shares with those same dividends during a dip in equities like we are experiencing now.

Disruption.

The real concern over Coronavirus is how it will disrupt the supply chain since it originated in the geographic region where most products manufactured overseas and sold in the U.S. market also originates. As people call in sick or companies temporarily close as a precaution, manufacturing will slow. In an era where we only look at this quarter as a measure, you can expect fallout. Companies like Apple (AAPL) who concentrate all manufacturing in China and Wal-Mart (WMT) who rely on China for inventory are both examples of companies who could see impact first.

The biggest lesson the U.S. can learn from this is to diversify production and suppliers. The idea of concentrating so much manufacturing in China has never made sense to me. President Trump’s warm reception in India during his visit shows promise of a potential trade deal favorable to manufacturing for U.S. based companies. USMCA may well aid in geographic diversity of manufacturing and reduce the future impact of country specific disruptions.

Avoid this same mistake of not diversifying in your portfolio and understand that there is more to it than a collection of different holdings. Asset allocation is a process of making different holding work together.

We’ll come out OK.

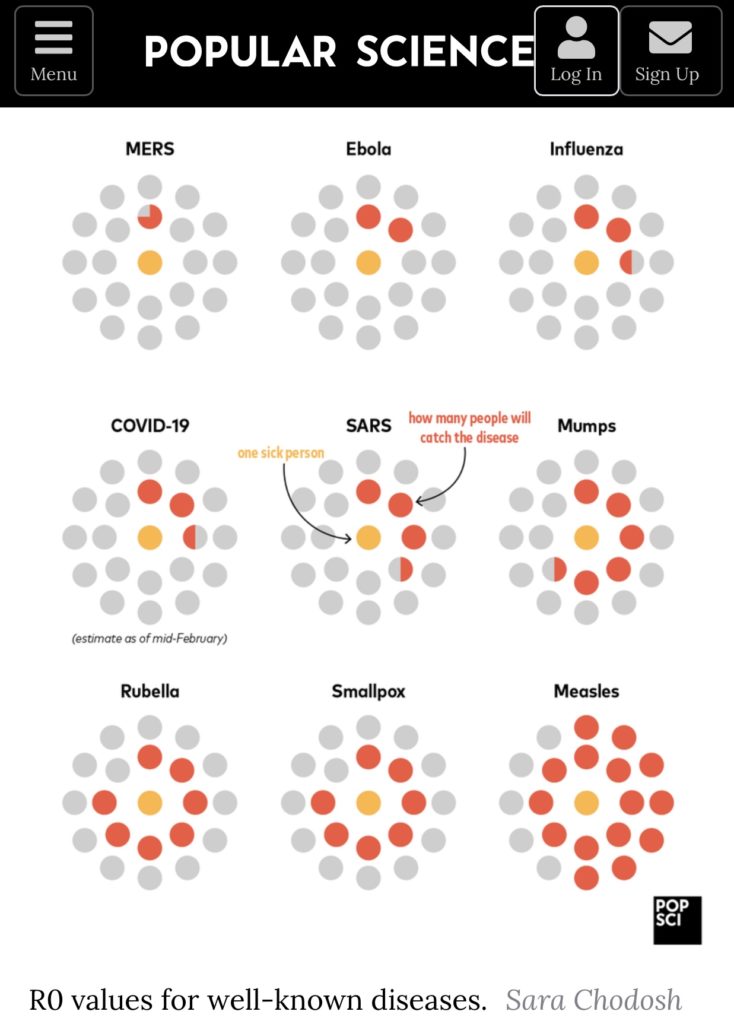

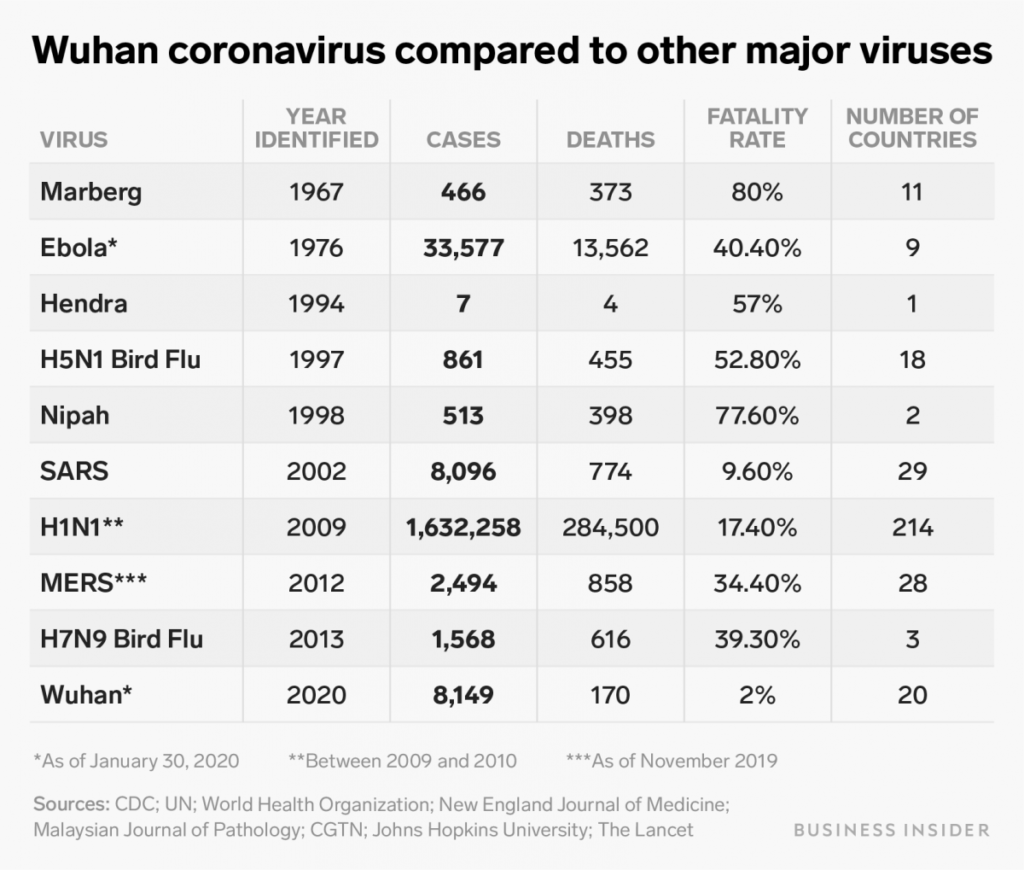

We’ve been through similar before, SARS, Avian and Swine Flu. We shook them off just like we’ll shake this off, too. Be glad that you set up proper asset allocation, have an emergency fund and did not invest next month’s mortgage payment in the stock market. If you find yourself unsettled and concerned send me a message it discuss it further and how things impact your situation.